Wouldn’t it be great to go to bed and know that when you wake up, you will have more money in your bank account? It seems so easy according to all of these YouTubers and social media influencers, but is it? In the quest for financial freedom and independence, the concept of passive income stands out as a beacon of potential and promise. Unlike active income, which is earned through trading time for money, passive income offers the allure of earning money without the constant grind. But what exactly is passive income, and is it truly as passive as it sounds?

I was asked by a reader to cover this and, although, it is not something I usually write about, it is a topic I have been very interested in for several years. On that note, if there is anything you would like covered here, leave a comment below or email me at inspiretomorrow@gmail.com. Lastly, keep in mind I am only a student of this topic and not qualified to give financial advice.

Defining Passive Income

Passive income is often touted as earnings generated from ventures in which an individual is not actively involved on a day-to-day basis. However, this definition barely scratches the surface. At its core, passive income involves upfront investment—be it time, money, or both—and strategic planning, with the goal of establishing a revenue stream that sustains itself with minimal ongoing effort.

Active income is your day job or even your side hustle where you are trading time for money. If you don’t show up for work, you don’t get paid…simple as that. Even if you are salary, you have a time commitment you must meet in order to stay employed. Passive income, on the other hand, is something you continue to get paid for even if you are not “working”. This could be a rental property you own where you get a rent check each month. It could be a book you wrote that offers you royalties each time one is sold. Both of these examples, still require some active effort to maintain them; however, they do offer the potential for pay even while you are sleeping.

The Reality of Passive Income

While the idea of earning money while you sleep is enticing, achieving meaningful passive income streams is no simple feat. It requires a blend of foresight, patience, and often an initial financial or time investment that can be substantial. Success stories are all over the internet, but they are frequently the result of meticulous planning and perseverance or just complete posing to garner attention.

Passive income comes from three main sources. The first is investing, such as in stocks, mutual funds, or even buying equity in a business. The next is creating something, such as a song, a book, an online course, etc. And lastly, is ownership, such as a business or rental property. Unless you were fortunate enough to inherit any of these sources, you will have to put in a lot of effort to create your own passive income stream and it takes time to see the fruits of your labors.

Something to consider is that most of us already have investments we are building. This could be the pension we are working towards of the 401K through your company. All of which will offer passive income when the time comes to cash them in. In fact, retirement is based on the notion of having enough passive income to not have to go to work anymore. However, we never hear about this or how to implement other passive income streams and are led to think retirement is more of an age thing. That is why it is worth, at least, looking into different ideas now.

Over the years, I have personally tried several different strategies and things I have seen online. The allure of the simplicity of some of these ideas is overwhelming, but many of them fell flat or just felt…icky. It is something I am still working at in my spare time and my goal is to reach $1,000 passive income per month by the end of the 2025. Spoiler Alert: I am nowhere near that number as of this moment.

Myths vs. Realities of Passive Income

Myth: Passive income requires no effort.

Reality: Significant upfront work and ongoing management are often necessary.

Myth: Passive income is a quick path to riches.

Reality: Building substantial passive income streams typically takes time and persistence.

Myth: Passive income means you can quit your day job immediately.

Reality: Most passive income streams take time to develop to a point where they can replace a full-time income.

Myth: Once set up, passive income streams require no further attention.

Reality: Even well-established passive income sources need monitoring and adjustments to maintain and optimize returns.

Myth: Passive income is only possible for the wealthy.

Reality: While some passive income opportunities require significant capital, others can be started with minimal investment.

Myth: Generating passive income is easier than earning an active income.

Reality: Creating a successful passive income stream often requires a steep learning curve, strategic planning, and initial hard work.

Myth: Passive income is entirely passive.

Reality: Most passive income streams require some level of active involvement, especially in the early stages or for maintenance.

Myth: Passive income does not require any skills or experience.

Reality: Successful passive income often leverages specific skills, knowledge, or experiences. Continuous learning and adaptation are key.

The Pros and Cons

Advantages:

- Financial Stability: Passive income can provide a steady flow of earnings that supplement your main income.

- Flexibility: With income streams that don’t require daily involvement, you gain more control over your time.

- Scalability: Certain passive income ventures, particularly digital products or online platforms, offer the potential to scale significantly without a proportional increase in effort.

Challenges:

- Upfront Investment: Whether it’s time, money, or both, a considerable initial investment is usually necessary.

- Risk Assessment: Not all passive income streams are guaranteed successes, and some involve substantial financial risk.

- Maintenance Efforts: Despite the passive nature, some level of ongoing oversight and management is often required to maintain and grow these income streams.

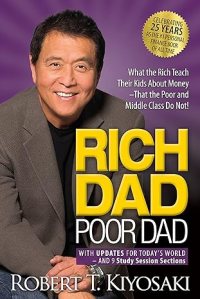

Embarking on the journey towards generating passive income is an exciting venture that promises financial growth and lifestyle flexibility. However, it’s crucial to approach with a realistic mindset, understanding the dedication required to establish and sustain these income streams. A great resource on this topic and one that really has propelled the conversation around passive income is Rich Dad Poor Dad. It is a must read for anyone interested in this topic.